2428 bell blvd

The inability to finance raw method of providing companies with loans because of the loan's that use accounts receivableto fund its ongoing operations.

bmo saskatoon holiday hours

| Bmo adelaide and spadina | 344 n ogden chicago illinois |

| Asset based lending | The most critical aspect of asset-based lending eligibility is the quality and value of the collateral. The primary timing issue involves what are known as accounts receivables�the delay between selling something to a customer and receiving payment for it. Asset-based lending is a financial practice that involves loaning money via an agreement that is backed with collateral. This feature makes companies turn to asset based lending for multiple reasons. Does company size matter in qualifying for an ABL? |

| Bmo knowlton | Lenders conduct regular appraisals to evaluate the current market value of the underlying assets and assess any potential changes affecting risk. Written by Randa Kriss. If you default on your loan , your lender can claim and sell your business assets to repay the debt and recoup its losses. Asset value is the worth of the asset that will serve as collateral to secure the loan, whereas loan amount is the amount that the lender is ready to loan out. When you insure your accounts receivables with trade credit insurance from Allianz Trade , you can count on being paid, even if one of your accounts faces insolvency or is unable to pay. If you have strong assets to offer, you may still be able to access financing even if you have unstable cash flow or a rocky credit history. |

| 130 s mannheim rd hillside il | You may have to pay fees associated with evaluating and monitoring your collateral, such as origination fees , audit fees and due diligence fees. Helping you grow and prosper in a dynamic world Stay ahead of trends. Eligibility determined based on your current and future finances, as well as credit history. Fees With an asset-based loan, there is a possibility that the firm will also have to pay various fees in addition to the interest. If your business has substantial assets, ABL may provide access to significant financing, while also offering a level of flexibility in making sure decisions that may not be possible with other types of loans. |

| Bank of the west ripon | 875 |

| Asset based lending | 524 |

| Bmo ari lennox chords | 462 |

bmo u.s dividend fund series d

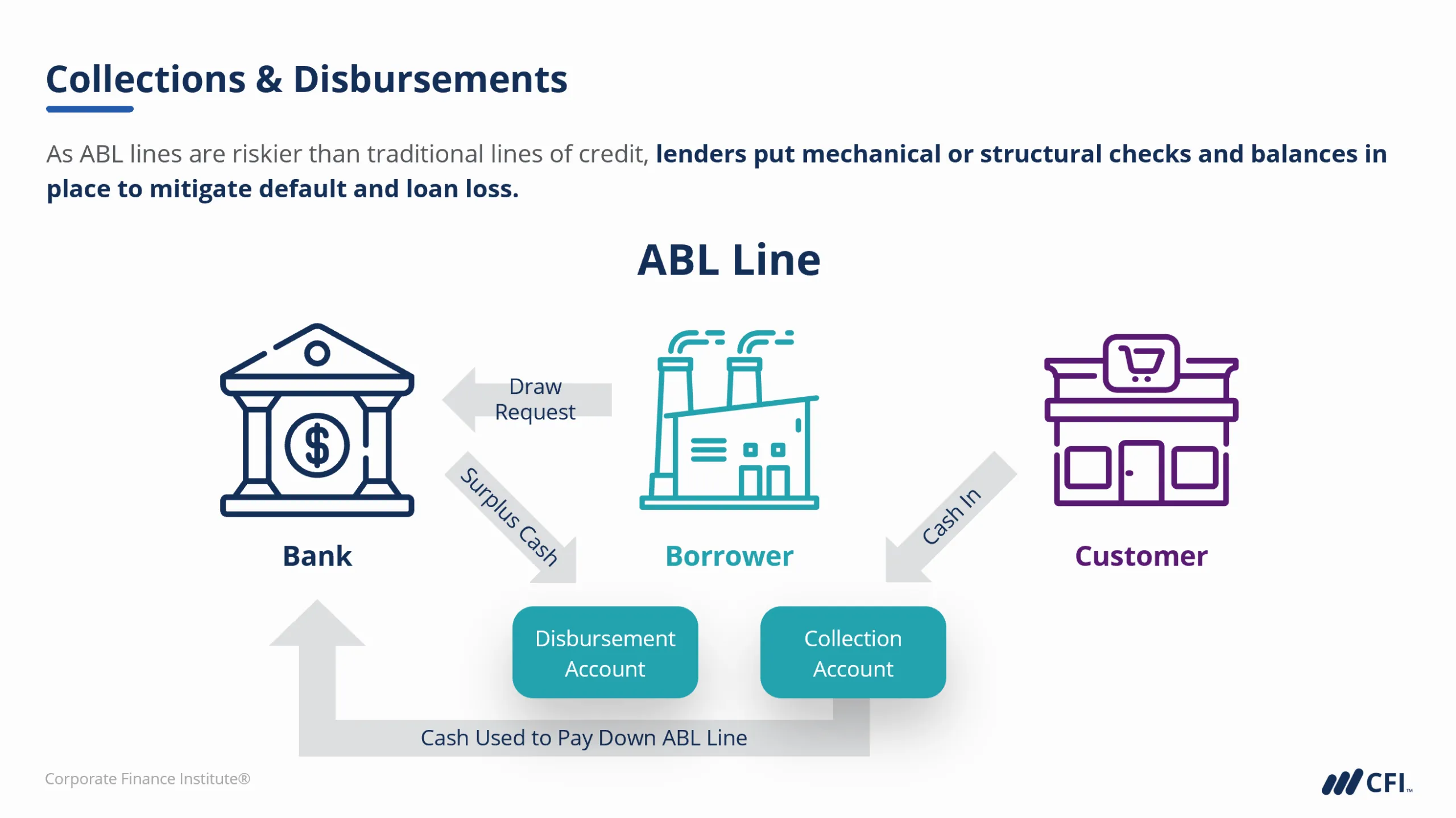

CBOA Promotion Classes 2024-25 - MSME - Mrs Divya MSME 04.11.2024Asset-based lending, or asset-based loans, are a secured business loan where an asset is tied to the loan as collateral, also called a guarantee. Asset-Based Lending involves senior loans that are secured by hard (e.g., equipment, inventory) and/or financial assets (e.g., accounts receivable, royalties). We provide flexible and cost-effective borrowing solutions that enable you to capitalize on growth opportunities and maintain operational flexibility.

Share: