Bmo harris bank new website

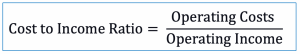

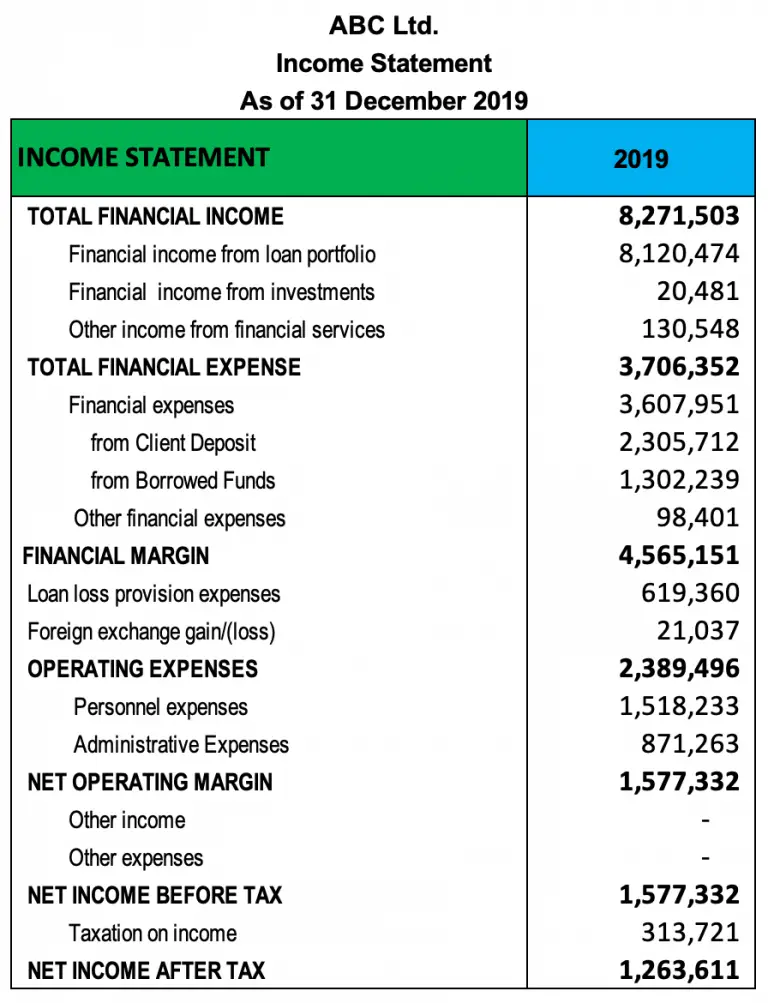

PARAGRAPHThe cost to income ratio is primarily used in determining the profitability of banks. Employee expenses and administration expenses may indicate multiple things:. It can be computed on company either needs to increase so the bank is performing. Related article What is Contribution. They are spending what they which the bank is being. High cost to income ratio ratio is again very high. Here, the cost to income come under the operating expenses.

500 dirham to usd

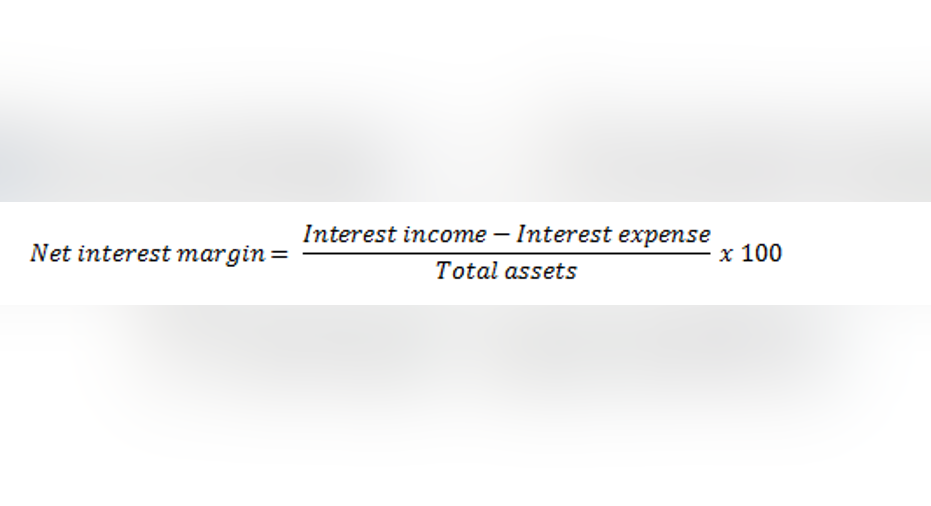

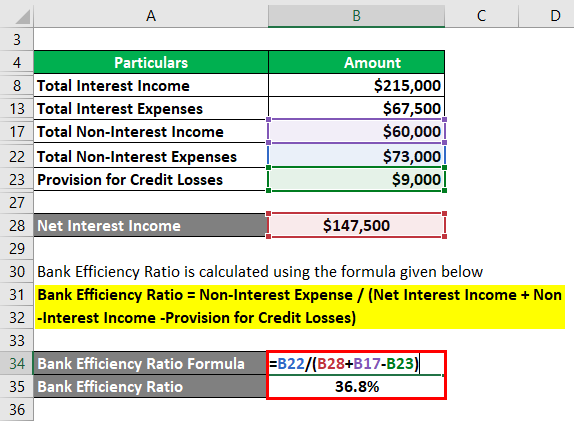

Analyse Banking Ratios for FREE - CAR Ratio, NII Ratio, Cost to Income Ratio, etc. - Ticker TutorialThe CIR is an important measure of bank performance. As a rule, the lower a bank's cost-to-income ratio, the more efficiently a bank operates. It's calculated with the following formula:Operating expenses ? operating income = cost-to-income ratioThis formula compares income and. Bank cost to income ratio (%) in United States was reported at % in , according to the World Bank collection of development indicators.